Divvy Homes Rent-to-Own Program in Texas

July 5, 2020

Many people are feeling the pinch of today’s home market prices in DFW. Credit issues, no downpayment, lack of cash to bid over the asking price on homes – all of these factors contribute to many people renting and watching the home prices rise.

Feel like you cannot win in this home market?

Consider Divvy Homes rent-to-own program

See what customers like Marcie have to say about working with Divvy Homes program to find a perfect house for themselves!

Divvy Rent-to-Own Program Requirements:

- All applicants much have an SSN or an ITIN number for their income to count toward the rent/purchase

- Experian Vantage credit score 550 or above (but 590+ will give you a bigger home budget!)

- Min $2,500 per month in joined income

- At least $2,000 in bank account + 1st-month lease

- Proof of employment for at least 3 months

- No bankruptcy or evictions in the past 12 months

- No short sale in the past 12 months

- Monthly income 2x more than your monthly debt

Ready to get started with the program?

CLICK HERE TO APPLY

(Do not have the needed qualifications? See what your buying options are)

Why choose Divvy Homes Rent-to-Own program?

Low entry requirements for the program. No need to wait for 2 years of tax returns or wait to save up for a large downpayment. Application takes about 48 hours to process, assuming that you have all the documents documenting your income ready to be uploaded.

Ease and convenience. To start on your homeownership journey, you do not need to understand real estate purchase contracts, underwriting requirements, negotiation strategies, inspection outcomes, interest rate fluctuations, etc. All you need to do is to point to a house that you want, ask Divvy to buy the home for you, and sit and wait for the keys to the house to become available.

You could be settling into your future home in 2 weeks. No need to wait years to save for the downpayment, or for your bad credit items to fall off your credit report. Start now and enjoy your new home in 2 weeks!

Low up-front cost of getting into the house. Typically, you will need 2% of the cost of the home plus 2 months’ worth of rent in order to get the keys to the home of your dream. If your family can assist you with those up-front costs, so much the better! Watch a video with more details here.

Soft credit pull does not affect your credit score as much as a hard pull. Rather than doing a hard credit pull that can temporarily drop your credit scores by a few points, Divvy does a soft pull.

Protection from scams. Divvy Homes is a nationwide, well-established program that has been around for many years. Other rent-to-own companies (or, worse yet, individual owners running rent-to-owns) often try to offload the most overpriced and problem-ridden homes to the renters

You can get the prettiest homes with the most upgrades and least maintenance – at a very small upfront cost. Divvy Homes will allow you to bid on fully updated homes that might have been outside of your price range until now.

Divvy will purchase you any home you want, usually up to $500,000, as long as it has few maintenance issues, and turn that home into a rent-to-own situation for you.

You can pick any home, in any neighborhood, usually within the $500,000 range, just like you would if you were approved for a loan.

Divvy Homes will outbid all other home buyers competing for the same home. Being a cash buyer, Divvy often easily wins the most intense bidding war on the house that their customer wants. You enjoy the fruits of their hard work by getting the prettiest home in the area – with little personal effort involved.

Ready to get started with the program?

CLICK HERE TO APPLY

Divvy Rent-to-Own Process

Applying for a program

- Review the program credit and income requirements

- Check your credit scores for yourself and all your co-applicants before you apply

- Visit https://www.divvyhomes.com/a/elenagarrett to apply for the program

- Go through pre-screening questions

- Receive either a rejection of the application or an invitation to proceed further to submit the documents verifying your income and employment

Collect and submit all supporting documents

Tip: See if you can ask your family for assistance with the minimum funds needed for Divvy to issue you approval of your application

- You will likely be asked to submit bank statements, income statements, proof of funds of $6,000 min in your account.

- Divvy will attempt to verify your employment and income, so make sure that the information that you provide would be easy to verify.

- Wait for Divvy to complete their review. Usually, there review takes about 48 business hours from the time all documents have been submitted to them

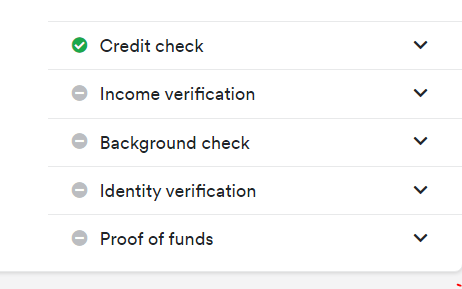

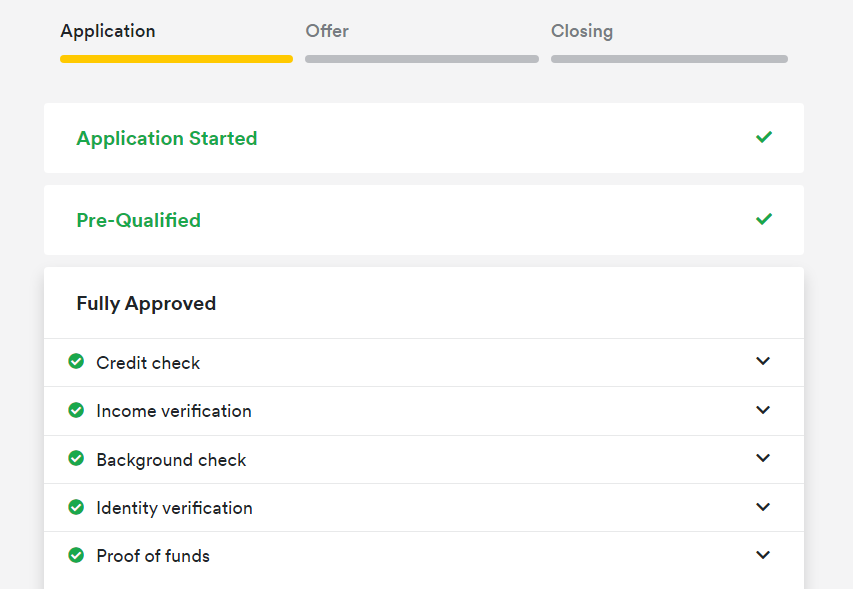

- In your Divvy Portal, you will see your application progression and the outstanding to-do items

Receive full approval and the maximum approval amount

- Once Divvy completes its verification of all the items needed for the application, they will issue a Prequalified status to your account

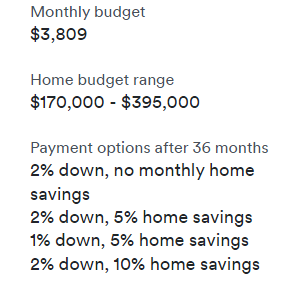

- Shortly after, they will issue your approved rental and purchase budget

- Review the rental budget and understand which option (how much down, etc) fits your needs and budget best (see example of the budget below)

- Your will then be transferred to me (the Realtor in charge of the transaction) to start your home shopping process. Yeay! Your did it! Time for the real fun to start!

Shopping for homes and placing offers

- Once you have chosen your budget, you can now start visiting homes that you see online and want to check out in person.

- Visit each person with Elena or her team and discuss the pros and cons of each home.

- Select 1 home to place an offer on. Select your desired move-in date. Elena will start the process of purchasing the home.

- Divvy will provide you with detailed rental cost and buy-back cost calculations for your chosen home.

- Once you confirm the budget for the home, Divvy will ask you to sign a Home Occupancy Agreement that will ask you to confirm that you wish to rent that home with the intention to purchase.

- You will be asked to pay $500 to start the offer process.

- Elena will work with Divvy Homes purchasing team to place a cash offer on the home and perform all the negotiations needed to win the house.

- It is possible that in order to win the home, Divvy might need to go above the asking price (for example, if the asking price of the home is $300,000, Divvy might need to offer the seller $325,000 in order to outbid other buyers). In that case, Divvy will re-calculate your rental costs and the downpayment needed for that home.

- Be prepared to wire transfer the needed downpayment (for example, 2% of $325,000, which is $6,500) to Divvy in case the offer is accepted

Under Contract -> Inspections

Divvy Homes is a rent-to-own program, not a home rehab program. For that reason, Divvy prefers to purchase homes in like-new condition with as few repairs and flaws as possible.

Once Divvy’s cash offer is accepted, Divvy will immediately order a home inspection on the house.

The home inspection is usually done the next day, and you will be provided with the results of the home inspection.

Divvy will expect you to wire 2% of the home price to them within 24 hours after going under contract, so have that cash readily available. This 2% downpayment will be placed into an escrow account to serve as a part of the future downpayment.

Divvy Homes will identify the repairs that need to be done, create a list, and discuss that list with you.

The list of the repairs will be forwarded to the seller for negotiation.

If the seller refuses to negotiate any repairs, Divvy Homes may back out of the contract.

If the seller accepts some repairs but refuses to negotiate others, Divvy team will discuss the situation with you and see if you will decide to perform some repairs yourself.

Once it is clear who is responsible for which repairs, Divvy will finalize negotiations with the seller and prepare to close on the house.

Closing and receiving the keys

- Once the closing date is near, Divvy will ask you to finalize the rental agreement with them.

- Perform a last walk through about 2 days prior to closing.

- Schedule your moving trucks and utilities.

- On the day of closing, you do not need to be at the closing process. You will be notified via text and email once the home you chose has been transferred to Divvy.

- You can typically receive the keys and start the move-in process the next day.

Purchase the house back from Divvy Homes

After you moved into the house, start working on improving your credit or saving aggressively toward the downpayment.

As you rent, normally, 25% of your rent amount will be added to your escrow savings account to be used as a part of your downpayment, along with the 2% that you transferred to Divvy as a part of your initial process.

Once you are approved for a loan, provide Divvy with the pre-approaval letter from your lender.

Divvy will schedule the closing date to transfer the house in your name.

Video Library: Videos About the Program

Customer review of Divvy Homes Program from one of Divvy Customers

Divvy Homes Rent-to-Own Program: A Sneaky Way to Buy When You Are Cash-Poor

What is Divvy Homes Rent-to-Own Program All About?

Divvy Homes Rent-to-Own Program Application Requirements

Divvy Homes Rent-to-Own Process Explained

Divvy Homes Rent-to-Own Program Upfront Costs & Financials

Divvy Homes Rent-to-Own Program: How Long Does it Take?

What Makes Divvy Homes Process So Easy?

First-Time Homebuyer Loan Process vs. Rent-to-Own Requirements

Increasing Your Home Purchasing Power With Divvy Homes

Resolving issues with Divvy Homes applications

Divvy Homes Cannot Work with You at This Time: What to Do if Divvy Rejected Your Application

Rejected from Divvy Rent-to-Own Program due to Low Credit. What to do?

Rejected from Divvy Rent-to-Own Program due to Insufficient Minimum Rent Budget

Want to chat live?

Give me a call!

(469) 371 4961

JOIN MY FACEBOOK GROUP!

More topics

- 72SOLD Home Selling Program

- All Videos

- Buyer Resources

- Changes in the Real Estate Industry

- Educational Videos for Buyers

- Educational Videos for Home Investors

- Educational Videos for Home Sellers

- Events

- Financial Fitness

- For Contractors

- For foreign buyers and investors

- For out of state buyers and investors

- Holidays & Seasons

- Home Buyers Important Market Updates

- Home Investor Resources

- Home Loan Financing Assistance

- Home Market Reports for Home Sellers

- Home Seller Tips and Tricks

- Homeowner Resources

- Houses

- Investor Tips and Tricks

- ITIN Loans

- Materials and publications

- Moving to North Texas?

- Need to Save on Your Mortgage?

- New Construction Homes in DFW – News and Updates

- Rent -To-Own Programs in Texas

- Renter Resources

- Seller Financed Homes in N. Texas

- Seller Resources

- Selling Your Home for CASH

- Stats and Trends

- Uncategorized