#Elena’s December 2021 Real Estate Update for BUYERS

December 25, 2021

Could a 1% interest rate increase rob you of $30,000 from your home loan?

IF YOU HAVE BEEN ON THE FENCE ABOUT BUYING A HOUSE, start paying attention to the current interest rates.

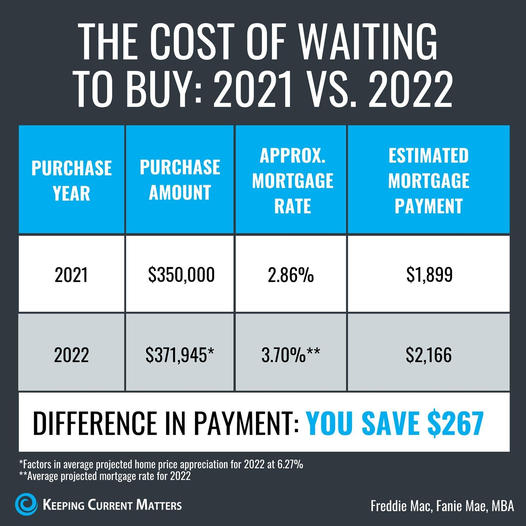

As per BankRate.com, the average rate for a 30-year fixed-rate mortgage is 3.37% as of December 25, 2021, compared to 2.86% at the same time last year. What does it mean for you?

It means that every time the interest rates increase, your ability to borrow money decreases, forcing you to be limited to SMALLER, older homes. In fact, a 1% interest rate increase can shave off $10,000, $20,000, $30,000, or more from the amount you can borrow to buy a house.

Warning: Rates can rise and fall overnight due to economic or political changes, so #Elena recommends locking your higher purchasing power before the rates start to rise again.

TO-DO: Consider buying sooner than later to lock in the interest rates now, before their projected increase during 2022.

Elena’s home buying forecast for 2022

In a word: the forecast is difficult.

The buyers planning to buy in the DFW area in 2022 need to be prepared for intense competition for homes, which means that they need to either 1) find ways to find the extra cash to win intense bidding wars to get into a house of their choice, or 2) come up with a house hacking strategy that would allow them to purchase a home that does not have a lot of buyer interest and, therefore, could be purchased at asking price (and not above asking price).

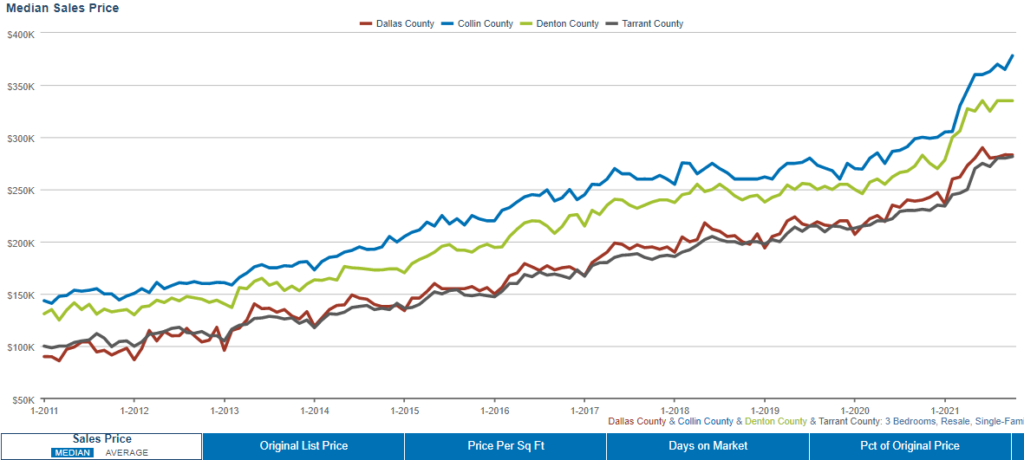

Additionally, every month, the home prices seem to rise by about $5,000 -$15,000 in price (depending on the area), therefore a 2-3 month delay in the purchase could push the prices up by $15,000 – $40,000, potentially making the home unaffordable to your budget.

TO-DO: Give Elena a call to discuss your plans, and she will be able to suggest the best purchasing strategy for your family.

Best months to buy in 2022

January – March and October- December

Traditionally, most shoppers try to buy their new home during the April – August period, especially when the school is out. The increase in the number of shoppers pushes the prices up significantly during April – August.

Are you a frugal shopper? You could save literally $50,000-$70,000 on your home purchase by avoiding purchasing during those months.

Notice the seasonal ups and downs in this chart of DFW home prices in the last 10 years.

TO-DO: Contact Elena to discuss your timeline and to see how she might be able to help you to avoid buying during the most expensive home-shopping seasons.

- 72SOLD Home Selling Program

- All Videos

- Buyer Resources

- Changes in the Real Estate Industry

- Educational Videos for Buyers

- Educational Videos for Home Investors

- Educational Videos for Home Sellers

- Events

- Financial Fitness

- For Contractors

- For foreign buyers and investors

- For out of state buyers and investors

- Holidays & Seasons

- Home Buyers Important Market Updates

- Home Investor Resources

- Home Loan Financing Assistance

- Home Market Reports for Home Sellers

- Home Seller Tips and Tricks

- Homeowner Resources

- Houses

- Investor Tips and Tricks

- ITIN Loans

- Materials and publications

- Moving to North Texas?

- Need to Save on Your Mortgage?

- New Construction Homes in DFW – News and Updates

- Rent -To-Own Programs in Texas

- Renter Resources

- Seller Financed Homes in N. Texas

- Seller Resources

- Selling Your Home for CASH

- Stats and Trends

- Uncategorized