May 2022 – DFW Housing Market Update

June 28, 2022

June 28, 2022

I think no one can argue at this point that rising inflation is starting to affect the home market in the DFW region.

How do those changes affect the homeowners who are planning to sell this year? I think it is important to start by looking at the trends that the realtors’ data is showing for the 4 main counties in the DFW area: Dallas county, Collin County, Tarrant County, and Denton County.

Let’s take a look at the main indicators.

Home Prices Start to Decline

(please note that these stats are for MAY 2022, not for June, as June stats won’t be in for a few more days)

We can see that Collin county is showing the sharpest decline in prices, followed by Dallas county. Tarrant county is showing almost no change (in May) and Denton county prices are still increasing.

People are Paying Less Above Asking Price

(please note that these stats are for MAY 2022, not for June, as June stats won’t be in for a few more days)

The graph below shows you how much in terms of percent of the asking price the house sold for. For example, “100%” means the house sold exactly for the same amount as the listing price. “110% SPLP” means the house sold higher than the listing price by 10%, while “90% SPLP” means the house sold for less than the listing price by 10%.

We can see that ALL counties in the graph show a sharp downward trend. But Collin and Denton counties are still selling slightly above the asking price while Dallas and Tarrant counties are starting to experience sales that are below the asking price.

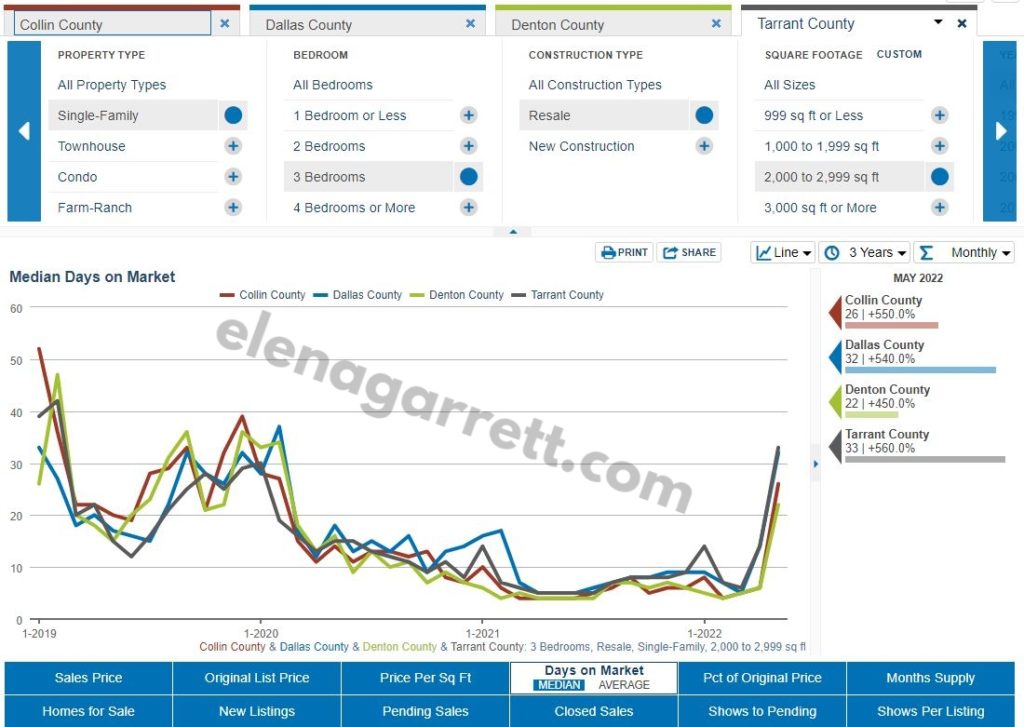

Days on the Market Are Increasing

Days on the Market is an indicator of how many days the house was “not under contract” (means, available for viewings).

As you can see, all four counties are showing nearly identical trends. If before the houses were on the market for 5-10 days in all counties, now the sellers can expect 20, 25, 30 days without a contract or longer. That means that the sellers need to count on being on the market for about a month before they are under contract (and then of course they need to remember that most contracts take 30 days to close).

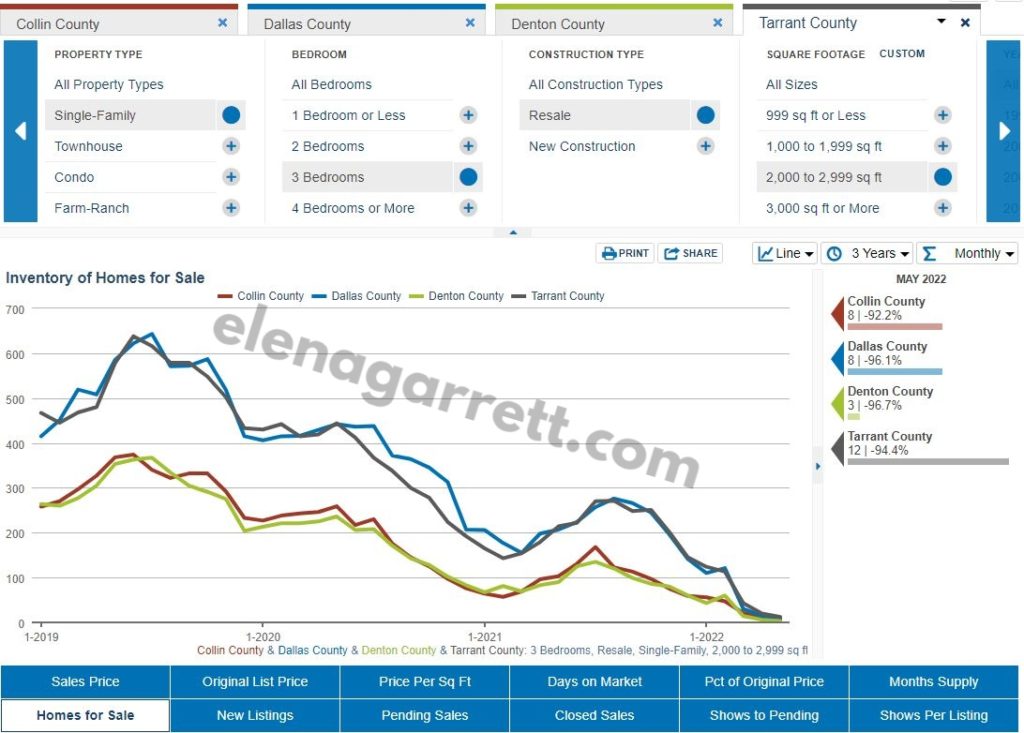

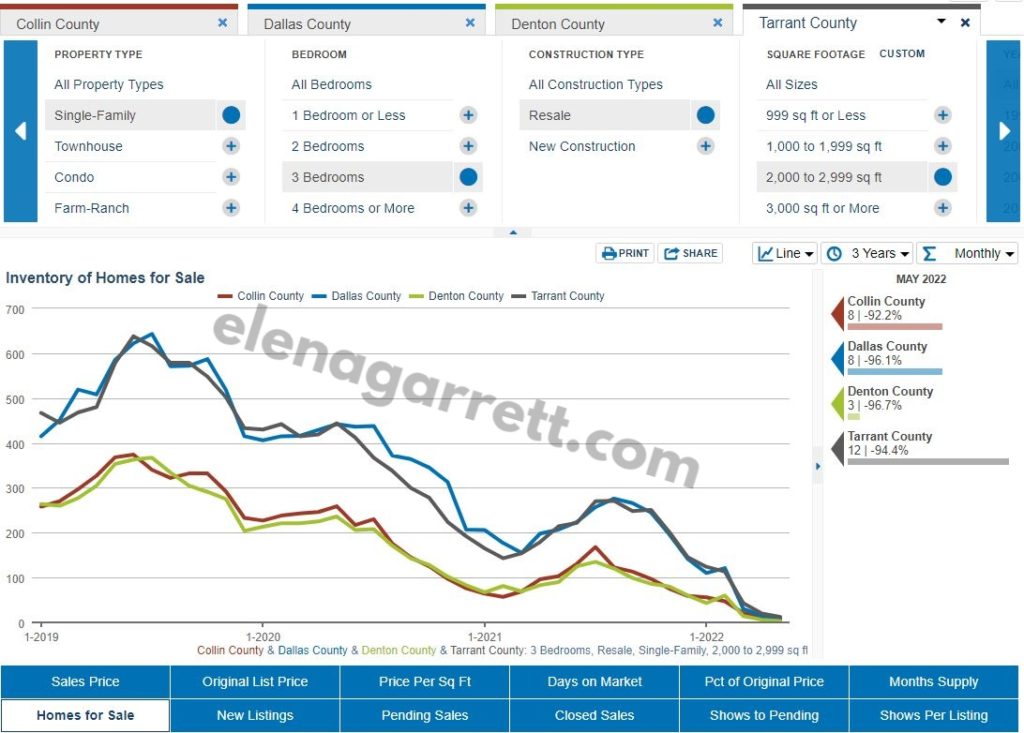

Are More Homes Available for Sale Now?

Based on the graph, the number of homes for sale is still very, very low. In fact, it seems to be decreasing compared to the February-March months, possibly due to the fact that many sellers who planned to sell this summer are getting spooked by inflation and rising interest rates. They may be deciding to wait to upgrade to a new home in order to avoid paying these high interest rates this year.

Since the supply of homes seems to be remaining low, this should keep the prices from falling even further.

Number of Buyers Looking at Homes Declines

Based on the graph, the number of people looking at homes is declining (thanks to rising interest rates). If in January or February the average home had 20-40 showings before going under contract, in May those numbers dropped to 2-5 showings.

That means that there is less competition among the buyers, leading to buyers making less generous offers as the buyers feel the market swinging in their direction.

What should home buyers and home sellers do in this changing market? I will be writing more on this topic shortly.

72sold advertising opportunities blog buy4cash Canadian citizens cash offers dfw housing market update events financial fitness for buyers for homeowners for investors for renters for sellers holidays houses industry news international home buyers itin knowledge articles legal and financial market updates monthly updates mortgage moving to Texas owner financed houses rent-to-own seller financed houses selling as-is special program stats stats and trends taxes tips and tricks videos videos for home buyers videos for investors videos for sellers