DFW 2024: A Home Buyer’s Preview into Market Dynamics and Potential Challenges

December 23, 2023

By Elena Garrett, December 22, 2023

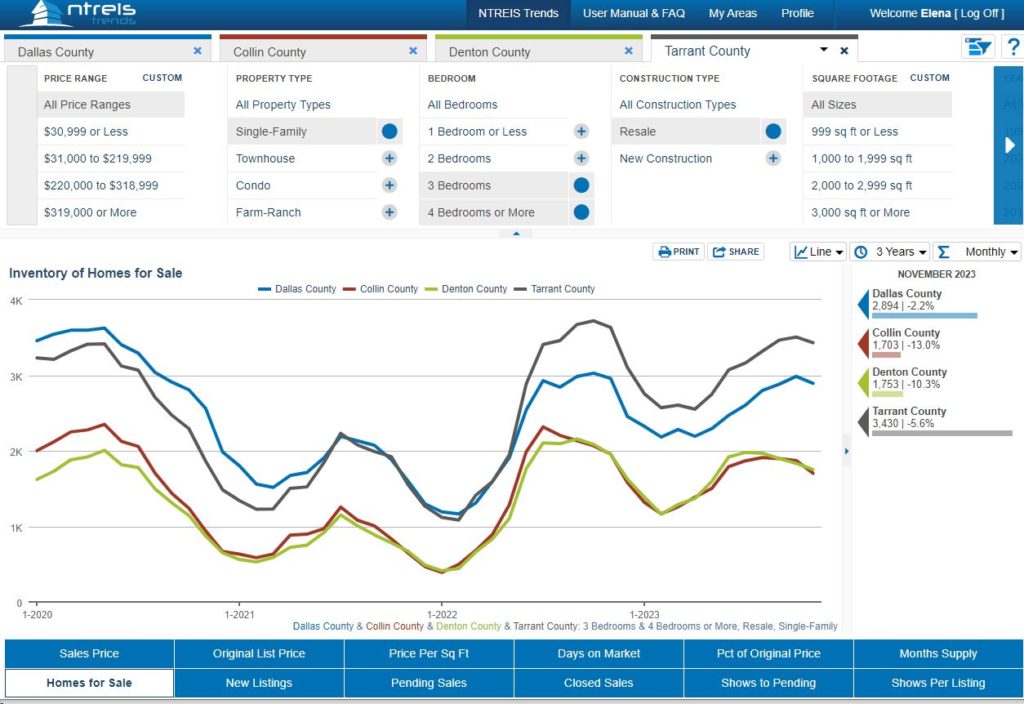

1. Dallas-Fort Worth Market Health

- The Dallas-Fort Worth (DFW) housing market in 2024 is showing promising signs for home buyers. Emerging from a period of high interest rates and surging prices, the market is stabilizing, offering a more balanced environment for buyers. This is particularly significant in a region known for its dynamic real estate landscape.

- Buyers should note that while the market is healthier, it’s not without challenges. Sales volumes might not skyrocket, and competition for quality homes could remain high. However, the stabilization of prices means that the market is less volatile, making it a good time for buyers to invest.

- As a buyer, understanding the DFW market’s nuances is crucial. Researching local trends, staying financially prepared, and working with experienced real estate professionals will be key to successfully navigating this market. The DFW area offers a range of opportunities for different budgets and lifestyles, making it a compelling market for prospective homeowners.

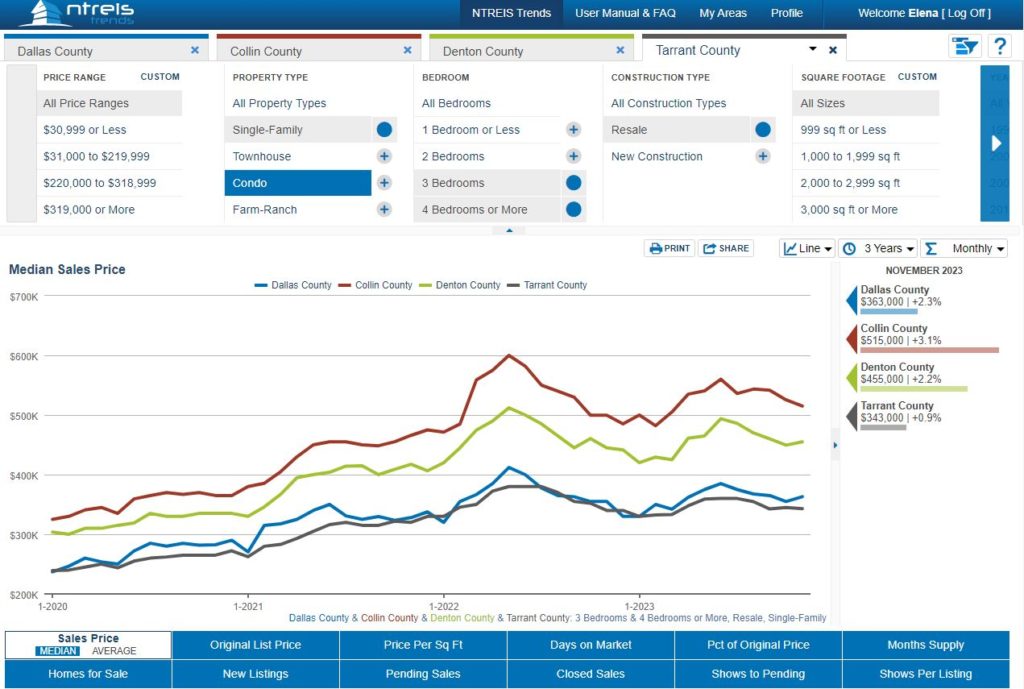

2. Pricing Trends in Key Texas Cities

- In North Texas, including the DFW area, home pricing trends are expected to vary in 2024. While some areas might see a decrease in home values, others are likely to experience modest increases. This variation creates diverse opportunities for buyers, depending on their preferred location and budget.

- Understanding the specific pricing trends in various neighborhoods is critical for buyers. Factors such as local economic growth, job opportunities, and housing supply will influence these trends. Buyers should consider these factors to identify areas that align with their investment goals and lifestyle needs.

- Exploring different neighborhoods and staying informed about local market conditions will empower buyers to make strategic decisions. Engaging with real estate experts who understand these micro-market trends will provide valuable insights, helping buyers find homes that offer the best value and meet their specific needs.

3. Election Year Impact on Housing Market

- The 2024 election year adds an element of uncertainty to the DFW housing market. Political changes can influence housing policies, mortgage rates, and market sentiment, impacting buyers’ decisions. Staying informed about political developments and their potential impact on the real estate market is crucial for buyers.

- Changes in housing policies and economic decisions during an election year can directly affect the real estate market. Buyers should keep an eye on these developments to anticipate market fluctuations. This awareness can help in making more stable and predictable buying decisions.

- Considering potential uncertainties, buying earlier in the year might be advantageous for buyers. This approach can help avoid the volatility that can occur in an election year, providing a more stable environment for making real estate investments.

4. Lending Predictions: Expect the Unexpected

- The lending market in North Texas is expected to be unpredictable in 2024. Buyers should prepare for fluctuations in mortgage rates and lending conditions by exploring various mortgage options. Understanding financial standing, credit score, and borrowing capacity will be essential in securing favorable mortgage deals.

- Staying flexible and informed about lending trends is crucial for buyers. Working with experienced mortgage advisors and financial planners can provide clarity and guidance in this uncertain lending environment. This preparation will be key to successfully financing a home purchase in North Texas.

5. Mortgage Rates: A Balancing Act

- Fluctuating mortgage rates in 2024 will significantly impact buyers in the DFW market. Staying informed about economic indicators and Federal Reserve policies, which influence mortgage rates, is essential. Buyers should consider locking in rates at opportune moments and adjust their budget according to changing rates.

- The ability to adapt to these changing mortgage rates will play a critical role in buyers’ financial planning. Seeking advice from financial experts and mortgage advisors will be crucial in navigating this aspect of the home buying process. Being prepared for rate fluctuations will help buyers make more informed decisions about their real estate investments.

Conclusion

Embarking on your home-buying journey in the dynamic Dallas-Fort Worth market? Don’t navigate these waters alone! Consulting with an experienced Realtor can make all the difference. An expert in the field can provide invaluable insights tailored to your specific needs, helping you understand the market trends and find the perfect home in North Texas.

#DFWRealEstate2024 #DallasFortWorthHousing #HomeBuyingTips2024 #DFWRealEstateForecast #DallasRealEstateInsights #FortWorthHousingTrends #2024PropertyMarketDFW #RealEstateAdviceDFW #DFWHomeBuyersGuide #TexasRealEstate2024

72sold advertising opportunities blog buy4cash Canadian citizens cash offers creative financing dfw housing market update events financial fitness for buyers for homeowners for investors for renters for sellers holidays houses industry news international home buyers itin knowledge articles legal and financial market updates monthly updates mortgage moving to Texas owner financed houses rent-to-own seller financed houses selling as-is special program stats stats and trends taxes tips and tricks videos videos for home buyers videos for investors videos for sellers