TX Home Sellers Year End Update – 2025

December 21, 2025

Home Market Prices in North Texas – What Exactly Happened?

Most home sellers are asking themselves: “Why aren’t prices going up like they did in 2021?”

Here’s what the numbers show:

- 2021–early 2022:

- Prices jumped fast

- Multiple offers were common

- Buyers rushed and overpaid

- Late 2022–2025:

- Prices stopped climbing

- Prices moved sideways or down

- No sharp rebounds, even after rate cuts

The price behavior since 2022 has been slow and controlled, not explosive.

Why today is not 2021

Both buyers and sellers are emotionally stuck in 2021-2022, for different reasons.

In 2021, due to COVID, many families who would normally move were hesitant, creating a temporary shortage of homes available for sale while at the same time the number of people moving to Texas to avoid COVID restrictions in other states spiked, making the shortage even worse. As a result, those homeowner who were willing to uproot and sell during this time were acting in the state of extremely low competition from other homes. As often happens during temporary shortages, those homes that WERE for sale immediately saw a huge amount of buyer interest, leading to multiple offers and above-asking-price sales even on mediocre or less-then-mediocre homes.

Since then, as the availability of homes returned to normal and even exceeded normal, the number of home buyers decreased, and the price bubble deflated. However, home sellers in 2025 are still emotionally “stuck” in the memories of 2021-2022 where their homes were showing Zillow estimates higher than they ever imagined. For many buyers, the bubble prices were “the true” value and they treat the normal market conditions as “wrong” and “unfair” because the normal market conditions cannot give them the “high” they experienced in 2021-2022.

On the other hand, buyers are also emotionally stuck in 2021-2022, since they could borrow money at never-seen-before interest rates of 2%-3%, and borrowers were on a “borrowing high,” empowered to buy much bigger and newer homes than they ever thought they could, at a cheaper monthly payments than their rent. That lead to the buyers viewing the normal financial market that generates normal interest rates as “wrong” and “unfair” because the normal market conditions cannot give them the “high” they experienced in 2021-2022.

Today’s real estate and borrowing markets make the mortgage payments to be significantly higher then rents, pushing many would-be-buyers to continue renting rather than buying, and that leads to many homes sitting unsold as there is now a shortage of buyers willing to pay more for a mortgage than they could pay for rent.

Government stimulus is gone

In 2021, stimulus checks were flowing, all kind of additional governmental assistance programs existed, and household cash was unusually high, giving the buyers a turbo-boost in cash and optimism.

Today, stimulus is over, buyers are using regular income again, and household consumer DEBTS (credit cards, loans) are record-high, making it even more difficult for the home buyers to get loans, as their debt-to-income ratios are pushing them into smaller and smaller mortgage payments. That in turn further diminishes the number of home buyers. The high-debt renters are willing to buy, but unable to obtain a loan on the type of homes that they see themselves living in.

Buyers are no longer in a rush

In 2021, during the home scarcity crisis, the low number of available homes and fast-rising prices drove the buyers to commit to a home they liked as quickly as possible. Buyers felt they had to act immediately to avoid being overbid in a multiple offer situation, and missing out on a nice, updated home felt worse than overpaying for it.

Today, with the number of homes for sale being HIGHER than normal and both prices and interest rates slowly dropping over the last 3 years, buyers move much slower. The excitement of 2021-2022 is gone, and the budget pains and constraints are the main drivers of their decisions. They feel that the cost of their mortgage is higher than their rent, the cost of other good and services also rose significantly, leaving them starved for cash. Therefore there is usually no urgency to commit to a much higher payment than they currently have. Also, since there seems to be a huge supply of eager sellers, buyers spend a lot more time comparing homes, shopping for deals, and waiting for more interest rate cut announcements from the Fed. Even when they encounter a house they really like, buyers walk away if the seller is not willing to give them a cut, as they know other desperate-to-sell sellers will negotiate with them aggressively.

What this really means for sellers

Despite the fact that both buyers and sellers feel that this market is “unfair” or ” bad”, the current market conditions and the current buyer behavior are actually quite “normal” when viewed through the lenses of pre-COVID “normal” conditions. Frankly, it was the COVID-restrictions-driven 2021-2022 market that was, in essence, an a Black Swan event of historical proportions, that created an abnormal and unsustainable buying frenzy of a short duration. The Black Swan event can never be a base-line, it is always an abnormality.

Prices, which nearly doubled during 2021-2022, have been dropping over the past 3 years to slowly find a new “normal” where the buyers pessimism and the buyers’ painful monthly payments determine the home market mood, and the sellers’ expectations of a sale price have softened.

That doesn’t mean homes won’t sell — it just means that homes in 2025 typically sell at the level of buyers mortgage affordability, not at the level of seller expectations. And unless a Black Swan event similar to COVID stimulus programs happens again, the “somber reality” of 2025 is likely to continue.

What sellers should NOT be doing

Based on the outcomes that we have observed throughout the 2025 ups and downs, the DFW home sellers are NOT advised to:

- Expect 2021-style price and demand levels from 2025-2026 buyers

- Price their home high “just to test the market” and “just in case someone really loves it”

- Allow their home to be priced higher than other homes in the same area

- Assume that incremental interest rates drops will suddenly bring back the 2021-2022 COVID-era prices and demand.

Because interest rates are just the “visible” enemy of their homes prices. The “invisible” enemy is the growing backlog of unsold homes and desperate-to-sell home sellers.

2025 – Too many nice, updated homes are sitting unsold

Most home sellers are asking themselves: “Why do buyers seem so demanding and picky right now?”

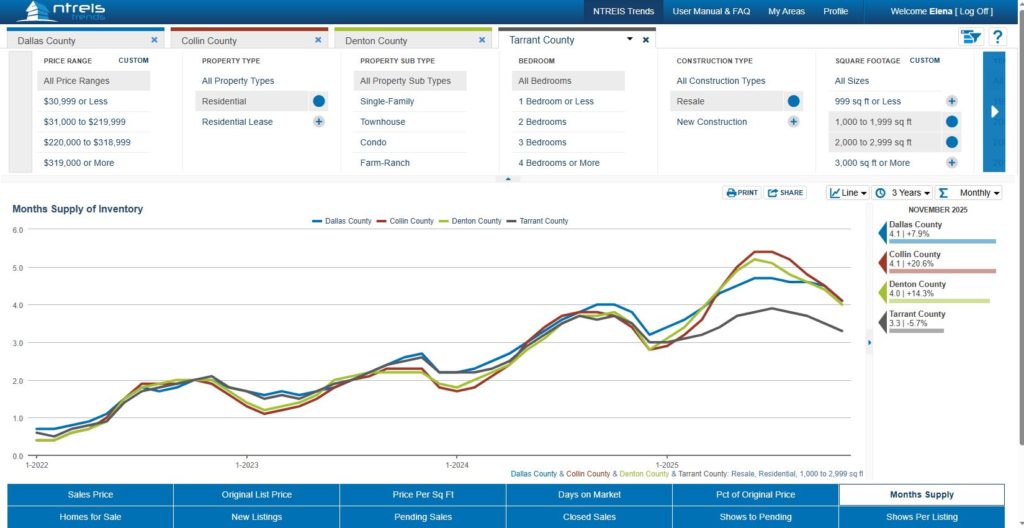

We looked at:

- Months of inventory from 2021 through 2025

- How many homes buyers could choose from at different times

- How inventory changes affect buyer behavior

This matters because:

Inventory shows who has the advantage — buyers or sellers.

What we found

Here’s what the numbers show:

- In 2021:

- The number of available homes was very, very low (due to many families being careful about letting people into their homes during the COVID restrictions)

- Buyers had very, very few choices and very, very intense competition from other home buyers

- As a result, homes sold quickly, with multiple offers, and often above asking price.

- From 2023 to 2025:

- The number of available homes sitting unsold for months climbed steadily

- Buyers had more, and more, and yet more options to chose from, creating analysis paralysis

- Lack of time pressure lead buyers to take longer and longer to decide which home checked ALL of their boxes

- As a result, homes took longer and longer to sell

What months of inventory actually means (plain English)

Think of it like this:

- Low number of available homes (inventory) = fewer homes to choose from, faster speed of sales, higher offers, buyers are in the passenger seat

- Higher number of available homes (inventory) = many homes to compare and analyze, lower speed of sale, lower offers, buyers are in the driver seat

When buyers see more, and more, and more homes:

- They instinctively slow down, overanalyze, and overcriticize, and have hard time focusing on a specific house

- They negotiate more aggressively and establish mental “because I m choosing this home, I deserve a price concession” attitude

- They skip homes that feel overpriced compared to other homes they are researching.

In an oversaturated, highly competitive environment, the sellers need to decide what is more important to them – waiting for the market to go back to the “COVID high and dry” conditions, or to move on with their plans now, in the middle of this ongoing market adjustment which may take another half a decade or a decade to complete.

If they chose to move on with their plans now, then the most important measure of how well the house is priced should be how the price compares to other similar homes in their neighborhood – and how to make their home MORE price-attractive to the financially strapped buyers.

Latest blog posts

- When a “Discounted” off-Market Rental Turns Into a Perfect Sh*t Storm

- Off-Market Deals for Finding Cash-Flowing Rentals: Pros and Cons

- Find Your Next DFW Rental Faster With This Simple Table

- Funny But Realistic New Year Resolutions

- The Emotional Hangover From the COVID Economy — And What it Means for Real Estate Decisions in 2026